The creation of a comprehensive property/assets statement is a non-trivial process, especially if one wishes to capture the history of asset development. It is necessary to understand certain non-trivial principles embedded in the Visible Money system.

Organization of asset records into asset profiles

A property statement consists of asset records. Each asset record has either a credit or debit character. A credit asset record is information that increases the net value of the user’s visible money assets, while a debit asset record, on the other hand, decreases the net value of the assets.

A typical credit asset record, for example, is information about the ownership of some asset – such as a property, a car, or money in an account. A typical debit asset record, on the other hand, is information about a liability – such as a mortgage, which somehow offsets the value of another credit asset record.

Asset records are organized for the purpose of joint evaluation into so-called asset profiles. An asset profile is formed by a set of asset records that are intended to be evaluated together. Each asset record belongs to exactly one asset profile.

The reason for organizing it in such a structure is that, for the purpose of providing a thorough description of the property statement, various asset profiles with differing details can be employed to achieve multiple perspectives on the assets, thereby describing them more comprehensively. A specific example: In my property statement, there are two properties – an apartment and a part of the house where I live. Thanks to the real estate boom that has occurred in Slovakia since I purchased these properties, the market value of both properties is significantly higher than the purchase price. If I were to include the market value of the properties in my property statement, it would distort the value of my assets. At first glance, the asset value would appear relatively large, and someone auditing these data might get the impression that I am a relatively wealthy person, which is true only to a certain extent. The size of the market value of my assets is inflated due to the inflated value of real estate. Therefore, from my perspective, it is more reasonable to create two asset profiles in the property statement. In their description, I will specify that one is inflated with the market value of real estate, and the other contains the purchase prices instead of market values.

Another good reason why it makes sense to have asset records organized into asset profiles is, for example, that asset profiles can be of two types:

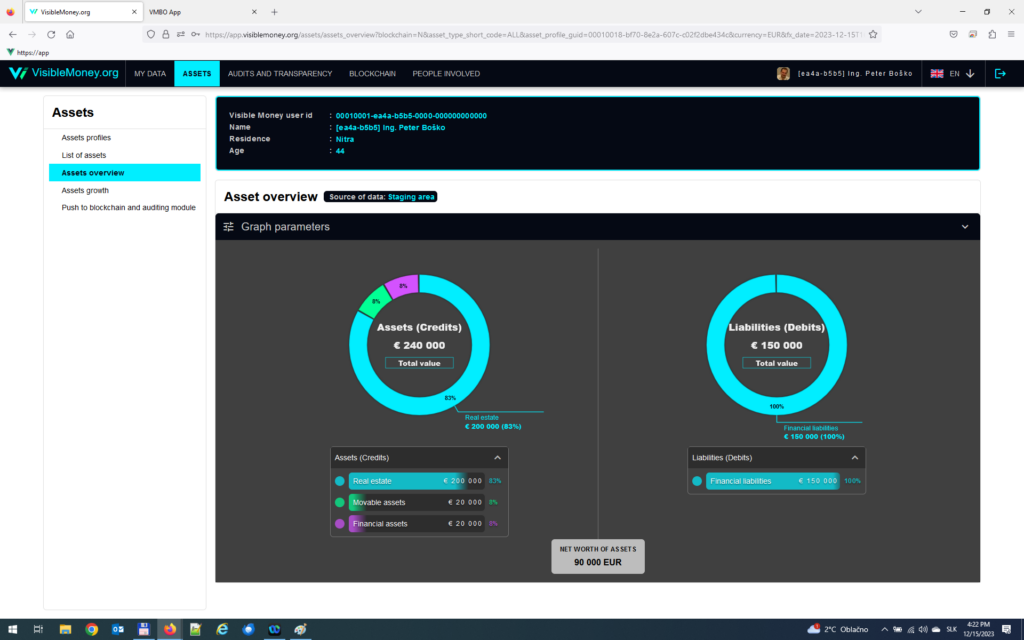

- Static asset profile: This contains a specified list of assets as of a particular date – this is a simpler type of asset profile. I recommend starting with this type when creating a property statement. A typical list of asset records for an individual might include:

| Type of asset | Credit/Debit record | Counted value |

| Flat | Credit | 200 000 |

| Car | Credit | 20 000 |

| Money | Credit | 20 000 |

| Mortgage | Debit | -150 000 |

| Net worth value | 90 000 |

The advantage of a static asset profile is that it is relatively simple to set up, and there’s no need to consider the history of assets when creating it. Its disadvantage, however, is that it doesn’t lend itself well to generating a meaningful graph of the asset value growth over time. This is because all asset records within it have an acquisition date, which is the date the static profile is compiled.

The system for such an asset profile generates the following structure of assets:

2. The deep/dynamic asset profile includes the history of asset records, illustrating how the user of Visible Money has evolved their current assets over time.

The fundamental difference between a static and dynamic asset profile is that the information in the records of the dynamic/deep asset profile should clarify how the user of Visible Money acquired their current assets. In contrast, a static asset profile merely states the assets at a specific time. For example, if a transaction occurred 10 years ago—such as the purchase of a property—and then the property was sold at a loss five years later, this information should be discernible from the records in the asset profile.

Another valuable tip for creating a dynamic asset profile is to have supporting official documents that broadly confirm the data entered into the asset records. In my case, it proved beneficial to request certain numbers from my tax returns from the beginning of my business to the present day from the tax office. However, the tax office did not have tax returns older than 2003, so I had to estimate previous numbers from my archive of bank account statements that I used at that time.

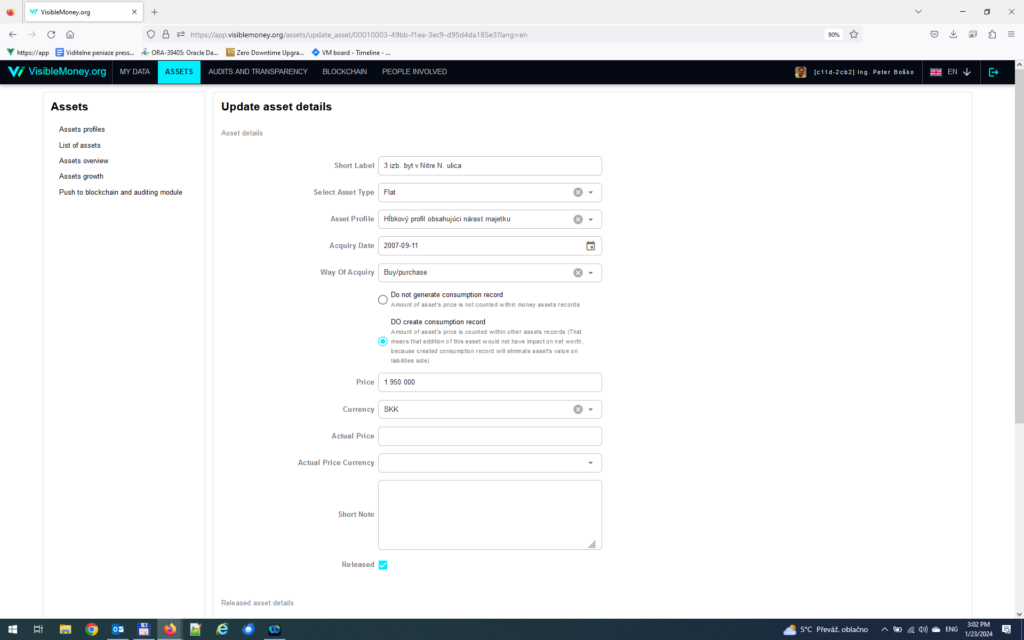

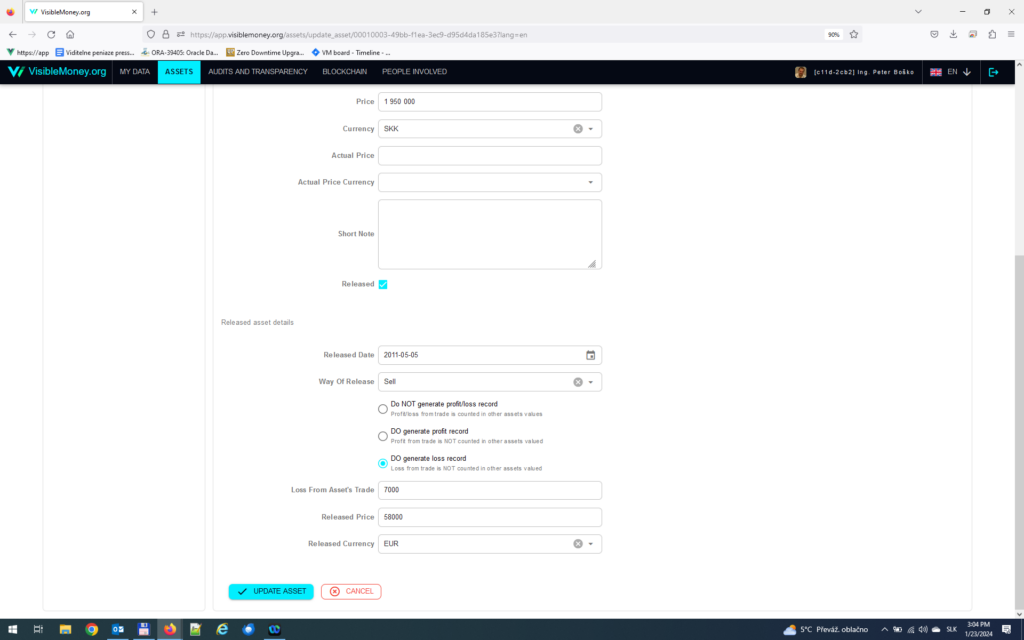

The following screenshots capture the record of an apartment that I purchased in 2007 for 1,950,000 SKK (Slovak Koruna), and in 2011, I sold it at a loss of 7,000 EUR.

In the case of a dynamic asset profile, entering asset records into it is carried out in such a way that earned money is initially input into the system, preferably in the coarsest form possible. If, for instance, we input super gross salary in the form of credit records “Money in the account,” it provides a good overview of our financial balance concerning the state. By entering, for example, super gross salary as a credit asset record, it allows us to have a clear overview of our financial position in relation to the state. Subsequently, debit records are entered into the system, which trim the (super) gross salary on the Credit side by the paid taxes and contributions (for this purpose, the system has a debit type of asset record – “Paid taxes and contributions”). Debit asset records also include items such as personal money consumption (type of debit record “Personal consumption – living expenses”) – the goal is to input super gross income on the credit side and then trim the expenses until we are left with a net value that has either increased or decreased from the net wealth.

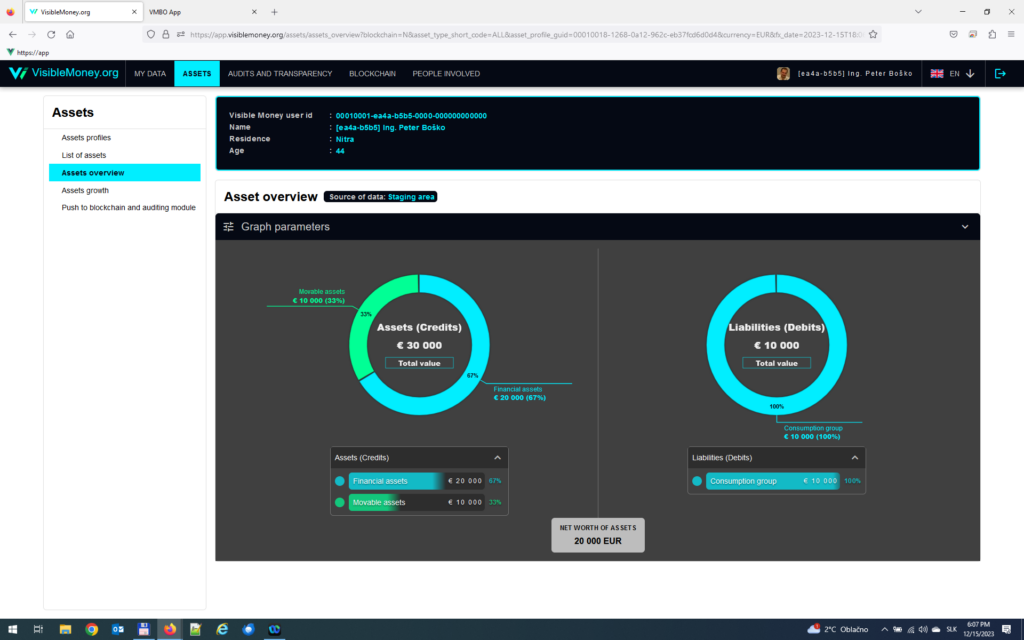

However, dynamic profiles have one technical disadvantage. Imagine that in 2001, you earned 20,000 EUR. In 2002, you used part of that money, 10,000 EUR, to buy a car. What is the net value of your assets in 2003? The answer is still 20,000 EUR; you just exchanged 10,000 EUR in your account for a 10,000 EUR car. The insight from this example is that the purchase of tangible assets does not affect the net value of assets (once we have already entered the money used to buy the asset into the system). It is merely a change in the structure of assets, not in their volume (assuming no extremely advantageous purchases or sales are considered). In dynamic asset profiles, we don’t want to lose information about earning 20,000 EUR in 2001. Even though there’s only 10,000 EUR in the account, if we were to go back in history and adjust the account balance as if we were spending the money, we would lose information. The fact that we earned 20,000 EUR in 2001 remains true, regardless of how much of that money we spent. Therefore, in dynamic asset profiles, such situations are addressed by adding the value of the purchased car (10,000 EUR) to the Credit operations in the asset profile. Additionally, a debit asset record of the type “Consumption” is generated in the asset profile, also with a value of 10,000 EUR. Generating such a “Consumption” record is not done automatically – the user is prompted to decide whether they want to generate such a record. This debit record also has a representation in the real world – it can be understood as an expression of the payment for the asset. By adding the value of 10,000 EUR on both the credit and debit sides of the asset profile, the net value of assets remains unchanged. However, the Credit asset operations side loses a bit of its informative value after such an operation and will look as follows:

As seen on the left side, the sum of Credits is 30,000, which is an artificial number with no basis in reality because it includes the value of the car counted twice. Once it was added as the sum of money earned, and the second time during the asset purchase operation for the car. When analyzing dynamic asset profiles, it’s essential to keep this in mind and remember that the sum of credits is not a meaningful number. It is always necessary to focus on the net asset value – that’s the figure with informative value.

Publishing asset records and asset profile records to the blockchain

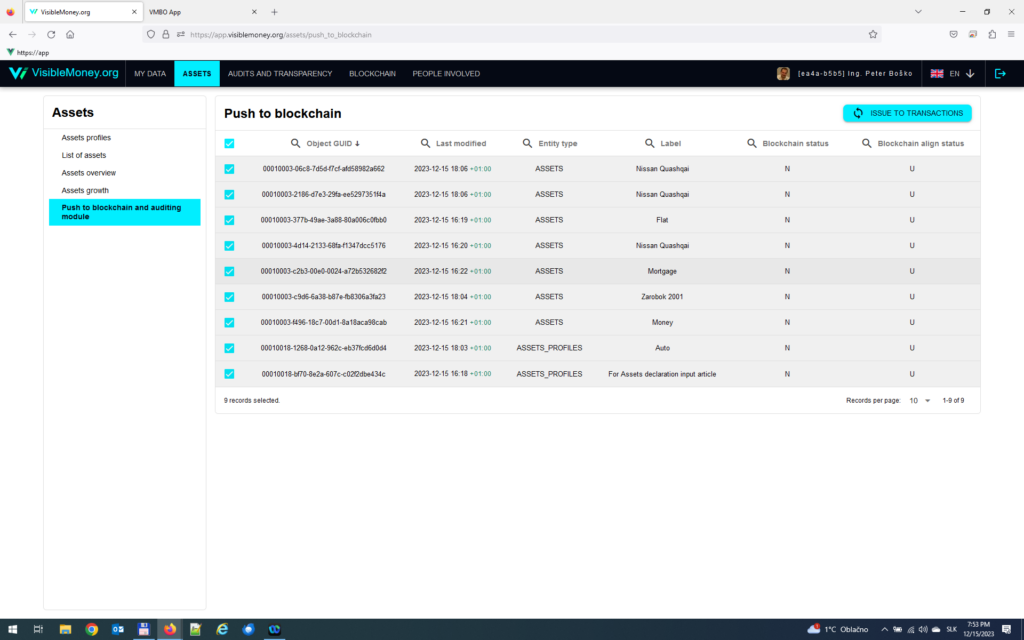

All data created in the Assets module are subject to a publishing mechanism to the blockchain, which operates in such a way that the user first creates their asset records and asset profile records. In the system, this preparatory storage is called the “Staging area.” Only when the user is satisfied with the created asset statement can they publish the data to the blockchain. This is done in the Assets\Push to blockchain and auditing module menu. On the screen, the user marks which records they want to send to the blockchain and presses the “Issue to transactions” button:

Subsequently, transactions with descriptions of asset records are created in the system. In the next run of creating a blockchain block, these transactions transform into data in the blockchain subsystem of the system. From this point forward, the data will be accessible in the auditing module for other users.

Visits: 28

One comment